In every cycle of the forex industry, brokers face the same challenge: how to remain relevant while the cost of technology keeps climbing. The market does not reward hesitation. It rewards efficiency and trust. That is why the idea of operating as a white label forex broker has moved from the margins into the center of discussion. What was once seen as a shortcut for small players has now become a strategy used by firms of all sizes.

The real value of a white label trading platform is not about replacing independence but about brokers deciding where their time, money, and focus will make the greatest impact.

The Hidden Cost of Building Alone

A brokerage may dream of building its own platform. Control, ownership, prestige – all of these appeal to ambitious founders. But behind the dream sits an uncomfortable reality. Development teams are expensive, servers need constant maintenance, and security requirements grow harsher with every new regulation.

Becoming a white label forex broker does not eliminate ambition. It redirects it. Instead of tying up capital in endless development cycles, a firm can launch within weeks, using a system that already works. The energy saved is spent where it matters most, i.e., finding traders, supporting them, and retaining them.

A Model That Outgrew Its First Purpose

In the early years, a forex white label arrangement offered little more than a logo swap. Brokers could call the platform their own, but they had almost no flexibility in how it worked. That era is long gone.

Modern solutions are ecosystems. They include mobile apps, liquidity access, risk management bridges, CRM integration, and reporting dashboards. They adapt to changing regulations and trader expectations without the broker footing the bill for research and development.

It is not an exaggeration to say the white label trading platform is now the infrastructure behind a significant portion of global retail trading.

Do White Label Platforms Limit Independence?

Brokers who hesitate often raise the same concern: “If the platform belongs to someone else, how can I stand out?”

The answer lies in understanding where clients place value. Traders interact with your brand, your spreads, your education, and your support team. They rarely ask who coded the backend. A white label forex broker keeps control over trading conditions, account types, and client experience. The provider stays invisible.

The independence that matters and the freedom to set pricing, decide markets, and build trust remains entirely in the broker’s hands.

Prop Trading and the New Revenue Stream

Another evolution deserves attention. Funded accounts have become one of the fastest-growing areas of trading. They require evaluation phases, strict risk limits, and automated scaling. Building these systems internally is a monumental task.

This is where the white label forex prop firm model comes in. Providers now supply platforms configured specifically for prop trading. Evaluation dashboards, payout automation, and account scaling are part of the package.

For a broker considering expansion, this is an opportunity to diversify without taking on the technical risk. A forex white label that supports prop trading not just helps in saving money but unlocks a new business model.

Technology That Evolves in the Background

Trader expectations rise every year. They want seamless mobile access, faster execution, and advanced charting tools. Meeting those expectations requires constant upgrades. For independent brokers, that means constant costs.

By contrast, a white label trading platform evolves continuously in the background. Providers integrate new features, strengthen security, and respond to market demands as part of the service. Brokers benefit immediately, without funding development teams or delaying launches.

This is why many established firms, once skeptical of outsourcing, now choose to remain white label permanently.

Liquidity, Risk, and the Broker’s Advantage

It is easy to forget that technology is only part of brokerage operations. Without strong liquidity and effective risk management, no platform can succeed.

Providers now offer built-in connections to multiple liquidity pools, creating tighter spreads and faster execution. Risk management bridges give brokers the tools to balance exposure, whether they operate as market makers or in a straight-through processing model.

For the white label forex broker, these capabilities are not add-ons but standard. The technology delivers competitive conditions without the broker carrying infrastructure costs.

Regulation: A Constant Pressure

No discussion of brokerage is complete without acknowledging regulation. Reporting requirements, KYC verification, and client fund protection are no longer optional.

Modern forex white label providers build compliance into their systems. Automated reporting, integrated verification tools, and audit-ready logs are delivered as part of the platform. The broker is still responsible for oversight, but the foundation is already there.

This removes a major barrier for smaller firms and gives larger firms confidence that their systems meet the standards of demanding jurisdictions.

The Rational Case

For brokers weighing their options, the rational case is straightforward. Becoming a white label forex broker reduces costs, accelerates market entry, and provides access to technology that evolves without draining internal budgets.

A white label trading platform can help companies retain independence in the areas that matter: client relationships, pricing, branding, and growth.

The forex market is unforgiving, and building alone is often a distraction. Brokers who choose white label solutions gain focus, speed, and stability.

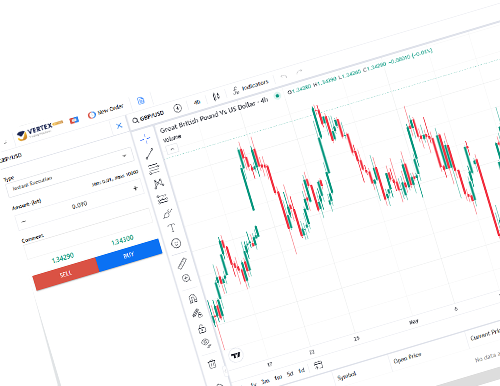

Hybrid Solutions offers Vertex, its flagship white label trading platform, designed specifically for brokers who want advanced functionality without the burden of development. Vertex combines liquidity access, integrated CRM, back-office management, and a risk control bridge within a scalable ecosystem. For brokers seeking a proven infrastructure that can grow with their business, Vertex provides both the reliability of a trusted provider and the flexibility required to build a competitive edge.