The right platform makes everything easy, but the wrong one? It makes even a simple trade feel like a chore.

If you want a smooth trading experience with a simple layout and good tools, you need to know what to look for in a platform before signing up. So how do you find which trading platform is best for you? Let’s break it down.

What Is a Trading Platform?

A trading platform is basically your entrance to the financial markets. It is the software provided by brokers that lets you trade forex, stocks, commodities and other assets. Irrespective of being a beginner looking for a simple interface or an experienced trader needing advanced charting tools, your platform determines how efficiently you can trade.”

The best forex trading platform is not just about good execution speeds or flashy design but about reliability, security and access to the instruments you want to trade. Some are web based, others offer mobile or desktop apps as well – but they all serve the same purpose: to help you buy and sell financial instruments at the right time.

What Do You Need from a Trading Platform?

There’s no one-size-fits-all answer to which trading platform is best because every trader has different needs. Some want lower fees, others need deep market analysis tools, while many just want an easy to use interface that does not require a finance degree to understand!

A good platform should have an intuitive design, solid market access and useful research tools. If you are new to trading, look for platforms that offer educational resources, a demo account and 24/7 customer support. Advanced traders should focus on order execution speed, technical indicators and automation capabilities.

Here are some key factors to keep in mind.

Key Points to Consider

Range of Asset Options

A platform’s value is determined by the range of assets it offers. If you are looking for the best forex trading platform, ensure it provides access to multiple assets with competitive spreads.

Verify if the platform supports crypto, stocks, indices, and commodities like gold and oil. The more options, the better to trade different markets under one account.

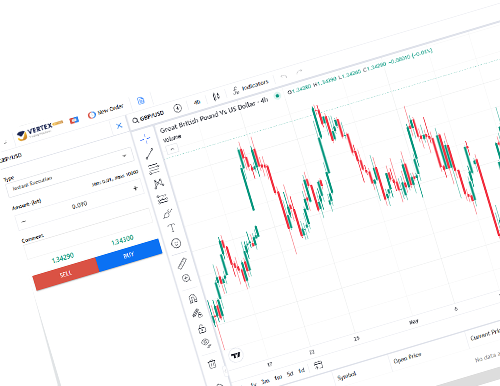

User Experience and Platform Design

A complicated platform can ruin your trading experience. It should be easy to use with a clean interface that lets you trade quickly.

If you want flexibility, a mobile app is a must. The best platforms have the same features on desktop and mobile, for a smooth trading experience. Some also let you customize, so you can manage charts, alerts and watchlists to suit your strategy

Research and Educational Tools

If you are serious about trading, you need access to good market research. Some platforms offer real time news, analyst reports and economic calendars to keep you informed.

For beginners, an educational section with video tutorials, webinars and trading guides can be a lifeline. A best trading platform should help you learn, not just trade.

Execution Speed and Order Processing

Speed matters in trading. A platform with slow execution can lead to missed opportunities or slippage, where you end up entering a trade at a worse price than expected.

The best trading platform should have:

- Fast execution times where trades should be processed in real-time without delays.

- Low latency.

- Advanced order types like limit orders, stop-loss, trailing stops, and one-click trading should be available.

If your trading strategy relies on precision, choosing a platform with fast and reliable execution is key.

Trading Tools and Features

A good trading platform is not just a place to buy and sell, it should help you trade smarter. Some of the most useful features include customizable indicators, multiple timeframes, risk management options and drawing tools.

Choosing the best forex trading platform means ensuring it has the features that align with your trading strategy.

If you are interested in automation, look for platforms that support algorithmic trading or allow third-party integrations. Some even offer robo-advisors that manage investments based on pre-set risk levels.

Security

Account security is equally important. Two-factor authentication, encryption protocols, and segregated client funds are key safety measures to look for. If a platform lacks these, consider it a red flag.

Customer Support

When things go wrong, you want fast, reliable support. A strong trading platform should have 24/7 customer service via live chat, email, and phone.

Some platforms also have a detailed help center with FAQs and troubleshooting guides, which can be useful for resolving common issues without waiting for an agent.

Customization and Personalization

Not all traders use the same strategies, so a good trading platform should allow some level of personalization. Some platforms let users:

- Customize dashboards: Arrange charts, trading windows, and market feeds to fit your workflow.

- Set up alerts and notifications: Get real-time updates on price movements and news.

- Adjust chart settings: Change colors, layouts, and indicators to suit your trading style.

If you like to fine-tune your trading environment, look for a platform that offers flexible customization options.

What Should Brokers Look for in a Trading Platform?

If you are a broker, your platform choice is not just about what works for you. Your focus must be on your clients. Traders have different expectations, and your platform should meet their needs to retain them.

- Many traders compare fees before choosing a broker. Offering competitive spreads and commissions can attract more clients.

- The more markets your platform supports, the broader the trader base you can appeal to. Forex, stocks, and crypto trading are major attractions.

- A complicated interface can drive traders away. A clean, intuitive design enhances user retention.

- Offering robust charting features, technical indicators, and automated trading options makes your platform attractive to both beginners and advanced traders.

- Traders want assurance that their funds are safe. Regulatory oversight, strong encryption, and fund protection measures are non-negotiable.

- Providing 24/7 assistance ensures traders stay with your platform rather than switching to a competitor.

Selecting the best trading platform for your firm is about what your traders actually want. Brokers should focus on delivering a seamless experience, strong security, and a feature-rich environment to keep their clients engaged and satisfied.