Traders no longer rely on downloaded platforms with complicated setups and regular maintenance. In 2025, they expect to open their browser, log in, and manage everything from anywhere without missing a beat. This is what trading looks like now. For brokers, offering a web-based trading platform is quickly becoming a requirement, not a feature.

Why Clients Are Choosing Web-Based Platforms

For traders, time is everything. The old model of installing terminals on desktop machines does not fit with modern habits. Someone at their desk, traveling, or checking the markets during lunch still wants a trading experience that keeps up. A web-based trading platform gives them that kind of freedom.

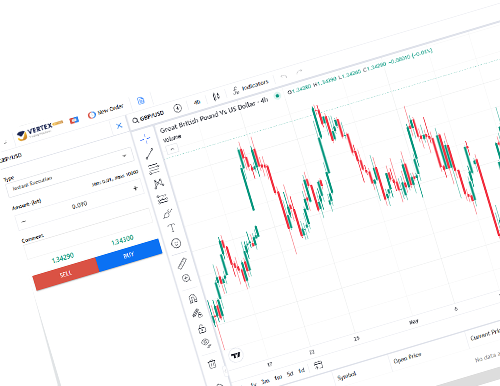

There is a clear demand for platforms that deliver high responsiveness. One of the most important benefits clients look for is web trading platform fast execution. When market conditions are volatile, traders cannot afford lags. A delay of even half a second can change outcomes, especially in forex or CFDs trading.

Clients also compare platforms by cost. Low margin rates are a major draw. Brokers offering web trading platform with low margin rates position themselves as more accessible and trader-friendly. And because these platforms update fees and rates live, users can track their positions with confidence. They know exactly what they are getting into.

Usability plays a big part, too. Modern platforms work seamlessly across devices. They load quickly, offer real-time pricing without refreshes, and let clients manage everything from placing trades to checking performance. That kind of functionality keeps users coming back.

Brokers Gain Far More Than Just Convenience

Running a brokerage is about much more than serving traders. Internal operations, compliance, and platform management demand attention every day. That is where a web-based trading platform creates real value.

Updates are deployed centrally, so brokers do not need to worry about version mismatches or manual software support. Client terminals are always current. That alone reduces client issues and minimizes the workload for support teams. Fewer complaints about installations or crashes translate directly into cost savings and happier users.

Security is also easier to manage. The best systems include built-in tools that align with industry-standard frameworks, including encrypted sessions, customizable permissions, session timeouts, and usage logs. Brokers can restrict access by department, keep activity records for audits, and monitor login attempts without third-party tools.

Onboarding new clients becomes easier, too. Without needing to download anything, new users can open accounts, verify details, and begin trading in minutes. That kind of experience increases conversions and improves retention.

Operationally, these platforms simplify team roles. Admins can assign specific access levels. Compliance officers can export reports on user behavior or trading history. Everything is tracked and stored in the cloud, reducing reliance on spreadsheets or manual checklists.

For firms expanding their teams or scaling up, these systems eliminate much of the growing pain. Processes stay structured, and the platform scales with the business.

Clients Want to Manage Portfolios, Not Wait on Reports

Traders now expect to handle every part of their account on their own. They want to see positions, check balances, monitor PnL, and adjust trades all in one place. A modern online trading platform makes this possible with real-time syncing and full portfolio access.

When a trader logs in, they expect accurate numbers and immediate updates. Sentiment indicators, asset news feeds, and dynamic order types all contribute to a smarter trading environment.

It is no longer enough to offer delayed insights. Clients demand live portfolio data with clear visualization. They want to see how their actions impact margin levels, how spreads affect positions, and how volatility plays out in real time.

This is especially important for active traders managing multiple instruments. They want to switch between forex, commodities, and indices without needing separate tools or tabs. A strong online trading platform offers multi-asset access from a single view. That efficiency keeps clients engaged and less likely to abandon trades mid-process.

Scalability Becomes Simple When It Is Built In

Growth does not have to mean complexity. One of the most powerful reasons to adopt a web-based trading platform is that it simplifies expansion. No matter if a broker is adding new clients or launching in new regions, the process is easier when everything runs through the cloud.

Modern platforms support multiple languages, regional configurations, and API connections. That means you can localize your service, plug into new payment providers, or adjust compliance tools without starting over.

For example, if a brokerage adds clients in Latin America, switching on a Spanish interface can be done in a few clicks. If expansion moves toward Southeast Asia, local KYC regulations and integration with regional payment gateways are available through extensions or API sync.

As brokers grow, the volume of trades, logins, and transactions increases. A strong web-based platform manages this smoothly, maintaining speed and stability even during peak activity. Built-in monitoring tools help firms stay in control by tracking account usage and system performance in real time. This ensures that the platform continues to deliver the same fast and reliable experience for every client, no matter how large the user base becomes.

It is not just the technology that scales. Teams scale with it. From support to sales to risk management, departments can access the tools they need without overlapping roles or permissions.

And because everything is browser-based, expansion does not require new servers, heavy infrastructure, or weeks of development work. The system grows as the business does, without disrupting operations.

Choosing the Best Web Trading Platform for Brokers

Not all platforms are created equally. Choosing the right one means looking for a system that aligns with client needs and business goals. In 2025, the best web trading platform for brokers is one that checks all the following boxes:

- Fast execution and minimal latency

- Transparent pricing with competitive spreads and margin rates

- Real-time portfolio management and reporting

- Seamless mobile and desktop compatibility

- Built-in security and compliance tools

- Multi-asset support with live news and analytics

- Scalable architecture and API integration

These are no longer premium features but standard expectations. A platform that does not meet them will struggle to retain users and may even fall behind in a crowded market.

A web-based trading platform brokers 2025 are adopting today is one that reduces risk, simplifies operations, and lets teams focus on delivering value rather than fixing problems. The technology works behind the scenes, while brokers concentrate on performance, trust, and user satisfaction.

In Closing

The right platform shapes the entire experience your clients have with your brand. From the moment they sign up to their first withdrawal, they are interacting with your platform every step of the way. That experience determines how long they stay, how often they trade, and how confidently they recommend your firm.

A web-based trading platform that is fast, secure, and flexible improves operations as well as helps you grow. In 2025, this is about keeping pace with what clients expect.

If your brokerage has not yet made the switch to a modern online trading platform, now is the time to look ahead. The clients are already there. The market is growing. And the future is built in the browser.