Running a brokerage is not some distant, multi-year project anymore. If you have got the will, a modest budget, and the right partner, setting up your trading business can be a surprisingly straightforward process. You do not need to build a platform from zero or write thousands of lines of code. You just need to know how to start a white label forex brokerage the right way.

We are talking about a proper setup, under your brand, without spending months dealing with software and server headaches. This article breaks down what it really looks like to launch forex brokerage white label platform, from choosing your tools to managing cost, without all the vague theory.

What Does White Label Actually Mean Here?

You might have seen the term tossed around by providers and sales decks. But let’s make it simple. A white label forex broker setup means this: someone else built the platform, and you get to run it under your name, with your branding, your spreads, and your client base.

They handle the tech and you handle the business. You choose the logo, colors, commission model, account types, and it is yours on paper and in experience. No one sees the provider’s name.

Now, this is not a shortcut to a fully passive income stream. But if you are trying to start your own forex brokerage and avoid the heavy lifting of development, this is the realistic path forward.

And for those who want to launch forex brokerage quickly, it checks all the boxes. No deep code, no in-house development. Just execution, clients, and day-one delivery.

What Makes It Possible So Fast?

You would think launching something as complex as a trading platform would take a year. But not when you are leveraging a system that is already proven and pre-integrated.

When you launch forex brokerage white label platform, here’s what is usually included:

- A trader terminal for your clients

- Admin access to manage users, trades, and risk

- CRM integration

- Liquidity provider connectivity

- Full account management system

- Branding and customization options

That is all operational in a matter of days. Sometimes even less. That is why firms trying to launch forex brokerage quickly lean toward white label models. It reduces risk and accelerates testing. You can scale later. But for now, you just need to go live.

What Are the First Real Steps?

Here is the part where it becomes more than an idea. To actually start your own forex brokerage, you will need to handle five key tasks:

- Pick the Right Provider

Look for stability, real client references, and post-launch support. Do not just chase the cheapest offer.

- Decide How You Will Operate

Decide if you will run an A-Book (direct market access) or B-Book (internal risk management) model. This determines your commission structure, spreads, and risk strategy.

- Build the Brand Experience

Design your platform visuals and decide what your clients will interact with. Custom mobile apps, web terminal branding, and even how your domain looks.

- Connect the Parts

Set your liquidity bridge, configure trader groups, map commissions. This is the back-office alignment that shapes your operations.

- Go Live and Learn Fast

You do not need perfection to start. You need responsiveness, solid onboarding, and a channel to fix issues quickly.

This is the core of a functional white label forex broker setup.

How Much Does It Cost?

The question comes early, and it should. Let’s break down what a white label forex brokerage cost typically includes:

- One-time setup fee (often includes branding and deployment)

- Monthly license for platform access

- CRM and admin interface

- Liquidity and data fees

- Optional integrations (KYC, affiliate systems, etc.)

This is not an expensive tech startup. Many brokers begin with a reasonable capital range and expand as revenue starts to flow. Knowing your limits helps. Paying extra for unused features does not.

But be clear on this: underestimating white label forex brokerage cost can be worse than overspending. You want room to grow without needing to rebuild your setup in six months.

Why White Label Is the Smarter Move for Most Newcomers

If you are asking whether it is better to build your own platform or white label, here is a counter-question: are you a tech company or a brokerage?

Because building a trading system from scratch requires:

- In-house developers

- Servers

- Ongoing security patches

- API documentation and updates

- A support team just for the platform

If you are simply trying to start your own forex brokerage, you do not need that right away. A white label model gives you market access, branding control, and full trade functionality without needing to become a platform vendor.

And let’s be honest, your time is better spent acquiring clients than debugging server logs. That is why so many brokers prefer to launch forex brokerage white label platform models and focus on growth, not tech infrastructure.

Tips That Make a Difference Long Term

The launch is only the beginning. Once your brokerage is running, the actual work begins.

Here are some underrated things that help keep your firm running smoothly:

- Answer support tickets fast as speed wins clients

- Monitor trade execution slippage

- Do not ignore mobile experience. Most new traders use phones first

- Use analytics to improve, not just for reporting, but for decision-making

- Think about education webinars, tutorials, even basic guides help

You do not have to be perfect at everything on day one. But if your platform is solid and your service is responsive, you are already ahead of half the market.

Bottom Line

You now know what a white label forex broker setup looks like, what it costs, and how it works. You know the decisions to make, what to prioritize, and how to avoid traps that slow others down.

The idea that you need millions or a full development team is outdated. If you know how to start a white label forex brokerage, you can move today. Not six months from now.

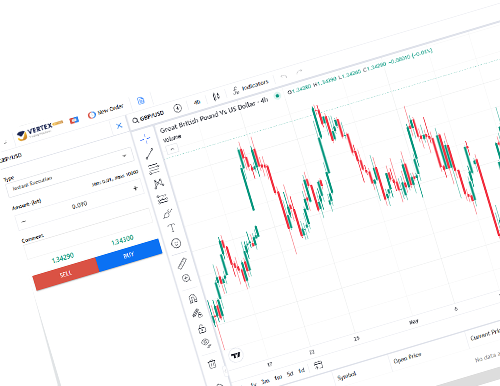

Hybrid Solutions offers a comprehensive white label solution through its Vertex platform, providing brokers with everything they need to establish and grow their operations. This includes a branded Client Terminal, a fully functional BackOffice system, and a high-performance Mobile Trading App, all underpinned by a secure, scalable trading infrastructure.

If your goal is to launch forex brokerage white label platform that is professional and fully operational, without the delays of building from scratch, Vertex delivers a reliable solution. With the right partner in place, your brokerage can move forward with clarity and confidence.