Trading platforms have come a long way from simple buy and sell functions. In 2025, traders want much more than just access to the market. They demand modern trading platform features 2025 that cover speed, insight, adaptability, and assurance.

This article explores the core features traders now expect and how platforms are evolving to keep up with those changing demands.

What Defines a Modern Trading Platform in 2025?

Traders today expect more than functional dashboards and basic charting tools. A modern trading platform is expected to offer a blend of powerful backend technology and clean, intuitive interfaces. The ability to customize settings, automate tasks, access high-speed execution, and analyze real-time data is now seen as the standard.

Beyond this, traders are also paying closer attention to privacy, platform stability, and integration with third-party tools. Reliability is just as important as innovation. In 2025, trading platforms are expected to do more while making it feel effortless for the user.

The Demand for AI-Powered Analytics

Smart data tools have gone from being a premium feature to a standard expectation. AI-powered analytics in trading platforms provide real-time insights into market conditions, helping traders spot opportunities and manage risk.

These tools do more than display numbers. They highlight unusual activity, generate trade ideas based on behavioral data and deliver customizable alerts when conditions meet user-defined thresholds.

With the rise of machine learning, many platforms also now feature AI-generated forecasts on trading platform dashboards. These forecasts do not predict the future but offer probability-based scenarios that help traders prepare for various outcomes. The integration of AI has become the baseline for modern trading.

Performance Still Matters – Speed and Latency

Traders may love analytics, but execution speed still sits at the heart of every decision. Low latency trading platforms continue to be in high demand, especially among day traders, scalpers, and high-volume users.

Every millisecond counts when placing a trade. A delay in execution can result in missed entries or slippage, which can affect profitability. To address this, platforms are investing in better routing, faster servers, and localized data centers to reduce the time between order placement and execution.

Low latency trading platforms now offer more than a technical benefit; they have become a core feature that traders expect from serious platforms.

Mobile-First Trading Platform Design Is No Longer Optional

Nowadays with smartphones and tablets offering nearly the same power as a desktop, users now expect mobile-first trading platform design as a default.

This means full charting capability, one-tap order execution, real-time notifications, and biometric security, all optimized for smaller screens. A mobile-first experience gives users the flexibility to trade when and where they want, without losing functionality.

In 2025, if a platform offers a limited or stripped-down mobile version, it risks losing the trust of modern traders.

Copy and Social Trading Features Gain Popularity

One of the most noticeable shifts in platform expectations has been the rise of social trading. Trading platforms with copy trading features are increasingly popular among new traders and casual investors who prefer to learn by following others.

These platforms allow users to browse verified trader profiles, view performance data, and copy trades in real time. Some even include leaderboards, social feeds, and community voting features.

Copy trading is not a niche add-on anymore. It is now considered a basic offering on many platforms, especially those targeting retail traders looking for shared insights or passive trading strategies.

Platform Integration and Infrastructure

While the user interface is what traders see, the underlying infrastructure is just as important. Broker integration with liquidity providers ensures that orders are filled quickly and at competitive prices. Integration with risk management tools, CRM systems, and payment gateways also contributes to a smoother user experience.

Modern platforms are expected to offer deep integration across systems. Traders may not see these features directly, but they certainly notice the difference in speed, reliability, and transparency.

Without robust backend support, even the most attractive interface can fall short.

What This Means for Brokers and Platform Providers

The line between casual and professional trading continues to blur. As a result, trading platform expectations 2025 are higher across the board. Traders expect smart tools, fast performance, mobile access, and reliable integration, all wrapped in a secure and intuitive platform.

For brokers and technology providers, this means staying current is not just about adding new features but also about delivering a cohesive ecosystem where every component supports the trader’s goals.

Real-World Examples Reflecting Trader Expectations

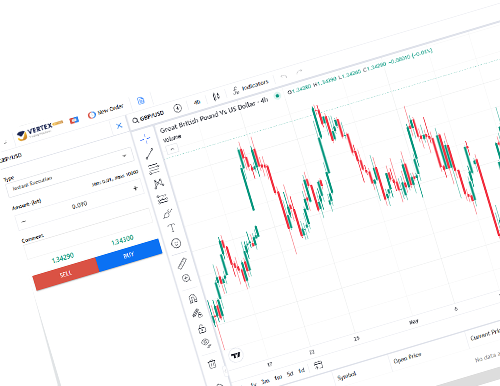

The features traders look for in 2025 are already reflected in how advanced systems are being built and delivered. One example is the Vertex platform by Hybrid Solutions, which is designed with a clear focus on performance, adaptability, and intelligent toolsets.

Vertex brings together real-time data access, mobile responsiveness, and built-in risk management features. Its infrastructure is optimized for fast execution, while offering full integration with liquidity providers, CRM systems, and market analysis tools. For traders who value stability and smart functionality in one place, Vertex is built to meet those expectations.

This combination of speed, flexibility, and comprehensive control shows how platforms are evolving to meet the new standard traders now expect.

Conclusion

As we move deeper into 2025, one thing is clear. Traders are no longer choosing platforms based on cost or marketing promises. They are choosing based on features, speed, user experience, and the ability to support real strategies.

Modern trading platform features 2025 include AI-powered analytics, low latency trading platforms, mobile-first trading platform design, and copy trading options among many more.

For technology providers like Hybrid Solutions, this means building trading environments that do not just look good but perform well, adapt to user needs, and stay ahead of changing market expectations.

The platforms that succeed will be the ones that stay grounded in what traders really want. Not more tools. Better tools. Delivered with purpose, and built to last.