Selecting the right trading platform is not just about swapping financial instruments – it is also about creating a trading empire for your clients and business.

The platform you pick shapes their entire experience, from happy clicks to frustrated exits. In this guide, we will outline the essentials to choosing the ideal trading platform for your brokerage company, ensuring your clients have a comprehensive toolkit to excel in the markets.

Understanding the Basics: What is a Trading Platform?

A trading platform is a software system mainly provided by brokers or other financial companies. It allows traders to buy and sell financial assets like currency pairs, stocks, indices, and other securities over an electronic platform. Today’s trading platforms include additional tools and services that can improve the trading process, such as automated trading systems and sophisticated packages.

Factors to Consider When Choosing a Trading Platform For Your Brokerage Business

Identify Your Brokerage’s Needs

It is important to start with a general understanding of your brokerage needs before considering a platform.

Are you targeting newbies, professionals, or both? What kind of securities will your clients be buying and selling? Do you need a comprehensive range of tools and charting products? Knowing these needs will help narrow down your options.

For example, if your clients are primarily new to trading, you might focus on simplistic platforms that offer a lot of tutorials and strong customer service. On the other hand, if you are targeting more experienced traders, you may be interested in platforms with more complex analytical tools.

User-Friendly Interface

The interface should be simple and intuitive. Even the most advanced platforms with numerous features may be useless if they are not convenient to work with.

Search for platforms with a user-friendly and clean design, where all the necessary tools and information can be located easily. The learning curve should be minimal, with sufficient guides and help sections to help users get acquainted with the platform.

Furthermore, a well-designed interface can provide an effective and risk-optimized trading zone to seasoned traders as well.

Enhanced Charting and Analysis Features

Sophisticated charting and analysis products are necessary for traders to study the markets and make proper decisions.

These tools enable traders to visualize market data using different chart types, apply indicators, and perform extensive analysis. Look for platforms that offer customizable charts, a large number of indicators, and real-time market data with minimum slippage.

Automated Trading Bots

Algo bots can trade based on defined parameters, thus enabling traders to capitalize on opportunities at any time. These bots are especially advantageous for high-frequency traders and those who wish to employ intricate trading strategies but do not have the time to monitor markets constantly. Furthermore, these bots can be utilized for backtesting, helping to refine and improve existing trade strategies.

You may consider platforms integrating such customizable, algo trading systems.

Risk Management Tools

Risk management is a very important factor for successful trading. Look for platforms that provide features like stop loss orders, margin level indicators, and position sizing indicators. These tools assist traders in managing their risks and optimizing the entry/exit positions.

Social Trading and Copy Trading Features

Social trading platforms enable users to mimic the actions of other expert traders. This feature is especially useful for newbies as they can watch how experienced traders work and try to emulate them.

Search for platforms that can support copy trading elements so your clients could be a copier or amplify their income as a master trader.

Mobile Trading App

With the current advancements in technology, the ability to trade on the go has become vital. Mobile trading applications allow traders to view their accounts, follow the markets, and trade anytime and anywhere.

Search for platforms that have powerful and functional mobile trading apps with real-time data, charts, and trading capabilities. The application must be easy to navigate, fast, and safe, allowing users to trade seamlessly.

News and Research Integration

Traders prefer to have access to the latest market news and research for making timely decisions. Select a platform that provides a news feed and market analysis reports by credible sources in real-time.

Customization and Personalization

The option of customizing the trading interface and tools to suit individual preferences can greatly improve the trading experience. Look for platforms that allow users to personalize their dashboards, create custom Watchlists, and set up alerts for specific market conditions. Such personalization can enhance effectiveness and overall satisfaction with the platform.

Security and Stability

Security is of paramount importance in the era of Internet trading. The platform you choose should have adequate security measures in place to safeguard the clients’ funds and information. Seek out those that have the highest levels of encryption, two-factor authentication, and frequent security checks.

Stability is equally important. The platform should be highly available with little to no unannounced outages and fast/snappy performance. This is particularly important during volatile market conditions when any slight delay can lead to substantial losses.

Transparent Fee Structure

It is crucial to have a clear fee schedule to establish trust with the clients. Choose a platform with specified commissions, spreads, and other costs. Stay away from forums that incorporate extra fees or have complex pricing structures.

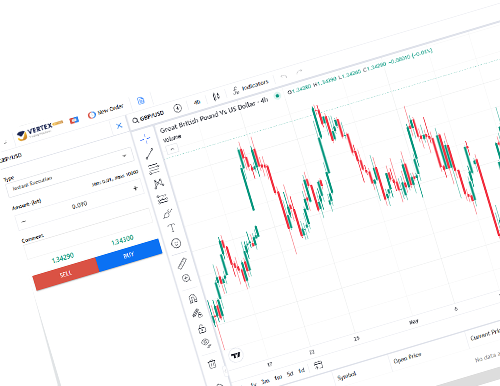

VetexFX Trader: A Leading Platform for Modern Brokers

In terms of choosing the trading platform, VetexFX stands out as a leading system that provides enhanced tools and a reliable environment for successful trading operations.

It supports swift trading speed, diverse charting tools, and one-click trading among other features. It also includes both the netting and hedging modes of trading as well as account types. Also, it has enhanced security measures for the protection of traders’ financial data and offers over a thousand free add-ons to suit clients’ needs and preferences. This makes VetexFX a perfect platform for traders seeking a reliable, secure, and fully equipped trading platform to thrive in the online trading arena.

Final Thoughts

Selecting the perfect trading platform for your brokerage is a complex but crucial task. By focusing on the needs of your clients, prioritizing user-friendly interfaces, analytical tools and features, robust security, transparent fees, and regulatory compliance, you can ensure that your chosen platform supports the growth and success of your brokerage.

Remember, the right trading platform is more than just a tool—it is a foundation for your brokerage’s future success. Take the time to evaluate your options carefully, and do not hesitate to invest in a platform that offers the best combination of features. With the right selection, you will be well-positioned to provide a superior trading experience and achieve your brokerage’s long-term goals.