Are you tired of making investment decisions based on guesswork and emotions? Technical Analysis is the solution for you. In this blog post, we will explain the key premises of technical analysis and how it can be used with VertexFX’s platform to help traders make a better investment and trading experience.

Technical analysis relies on the analysis of market activity data such as past prices and volume to identify patterns that can suggest future price movements. One of the key premises of technical analysis is that the market discounts everything. This means that all known information related to security is reflected in its current price. Therefore, as soon as new information manifests, it affects the price of the security, and technical analysts can use this information to make informed decisions.

Another premise of technical analysis is that prices move in trends. In technical analysis, prices of securities tend to move in observable trends, and the trend is considered flawless until the trend line is broken. Once a trend has been established, the future price movement is more likely to be in the same direction as the trend than against it.

The third premise of technical analysis is that history tends to repeat itself. Technical analysts study the history of a security’s price movements with the expectation that history will repeat itself. Chart patterns are often used in technical analysis, and even though they are based on historical data that is sometimes more than 100 years old, they are still believed to be relevant today because they clarify patterns in price movements that often repeat themselves.

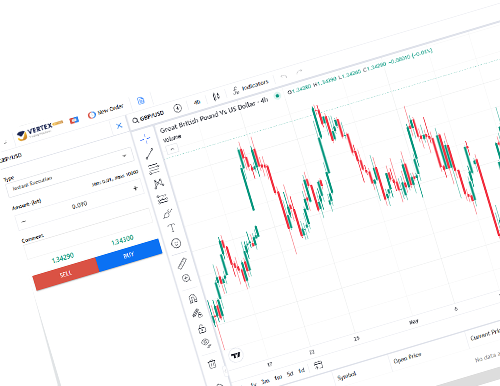

VertexFX’s technical analysis tool is designed to help traders apply these key premises to their investment strategies. Providing access to real-time market data and advanced charting tools enables traders to identify trends and patterns that may suggest future price movements. Also using the VertexFX Backtesting traders and technical analysts will be able to process the testing of trading strategy on relevant historical demo chart data to ensure its functionality before risking any real capital.

While technical analysis can provide traders and investors with a new set of tools to help them in their trading journey, it is not without limitations. Technical analysis only focuses on market action, which means it does not consider external factors that may affect a security’s price. Additionally, technical analysis is only one approach to analyzing stocks, and traders and investors should use the approach that they are most comfortable with.

In conclusion, VertexFX’s technical analysis tool is a powerful tool that traders and investors can use to make informed decisions about buying and selling securities. By understanding its benefits and limitations, traders and investors can use this approach alongside other tools and strategies to build a comprehensive investment strategy. Ultimately, all investments come with risks, and traders and investors must make their own decisions about whether an investment in any particular security is right for them based on their investment objectives, risk tolerance, and financial situation. Start using VertexFX’s technical analysis tool today and take your investment strategy to the next level.